Start planning for

gold with just one click

Gold Investment Plan

Benefits of investing with

Gold Investment Plan*

*Cut-off timing and Custody charges applicable.

How it Works

- Tell us what you aim to achieve

- We will help you plan as per your need

- Let's get started!

-

Investors are informed that by way of ‘Gold Investment Plan’ they would be systematically investing in units of Nippon India Gold Savings Fund (NIGSF), an Open Ended Fund of Fund Scheme investing in units of Nippon India ETF Gold BeES, an open ended exchange traded scheme with physical gold as an underlying asset. Investors are requested to note that they would be accumulating units of NIGSF (equivalent to price of physical gold subject to applicable NAV) and not physical Gold. For more details please refer FAQs

-

The investment objective of NIGSF is to seek to provide returns that closely correspond to returns provided by Nippon India ETF Gold BeES.

-

The asset allocation of NIGSF is as follows:

| Instruments |

|

Risk Profile | |||||

|---|---|---|---|---|---|---|---|

| Units of Nippon India ETF Gold BeES | 95 | 100 | Medium to High | ||||

| Reverse repo and /or Tri-Party Repo on Government Securities or T-bills and/or short-term fixed deposits and/or Schemes which invest predominantly in the money market securities or Liquid Schemes* | 0 | 5 | Low to Medium | ||||

*The Fund Manager may invest in Liquid Schemes of Nippon India Fund. However, the Fund Manager may invest in any other scheme of a mutual fund registered with SEBI, which invest predominantly in the money market securities.

- Investors may please note that they will be bearing the expenses of NIGSF in addition to the expenses of Nippon India ETF Gold BeES in which NIGSF scheme makes investment.

-

Loads:Entry Load:Nil

The following Load Structure is applicable during the new fund offer and continuous offer including SIP installments in the scheme till further notice. Entry Load - Nil In accordance with the requirements specified by the SEBI circular no. SEBI/IMD/CIR No.4/168230/09 dated June 30, 2009 no entry load will be charged for purchase / additional purchase / switch-in accepted by the Fund with effect from August 01, 2009. Similarly, no entry load will be charged with respect to applications for registrations under systematic investment plans/ systematic transfer plans accepted by the Fund with effect from August 01, 2009. With reference to SEBI circular No. SEBI/HO/IMD/DF2/CIR/P/2019/42 dated March 25, 2019, there shall be no entry load for investments under SIPs registered before August 01, 2009 with effect from April 15, 2019. The upfront commission on investment made by the investor, if any, will be paid to the ARN Holder (AMFI registered Distributor) directly by the investor, based on the investor’s assessment of various factors including service rendered by the ARN Holder. Pursuant to SEBI circular No. SEBI/IMD/CIR No. 14/120784/08 dated March 18, 2008, with effect from April 1, 2008, no entry load or exit load shall be charged in respect of units allotted on reinvestment of dividend. Exit Load - 1% - If redeemed or switched out on or before completion of 15 days from the date of allotment of units. Nil - If redeemed or switched out after completion of 15 days from the date of allotment of units. W.E.F. October 01, 2012, Exit Load If charged to the scheme shall be credited to the scheme immediately net of service tax, if any. For expense ratio for Nippon India Gold Savings Fund, please click this link: https://mf.nipponindiaim.com/investor-services/downloads/total-expense-ratio-of-mutual-fund-schemes https://mf.nipponindiaim.com/investor-services/downloads/total-expense-ratio-of-mutual-fund-schemes

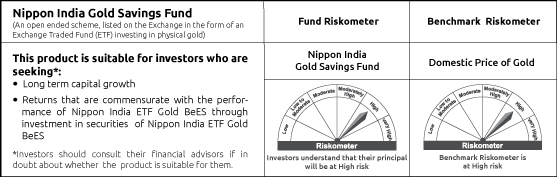

Nippon India Gold Savings Fund:

This product is suitable for investors who are seeking*:

|

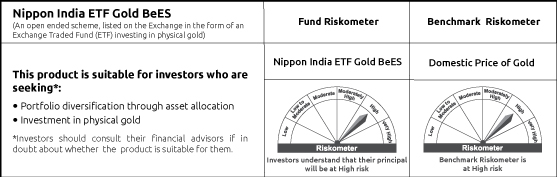

Nippon India ETF Gold BeES

This product is suitable for investors who are seeking*:

|