Frequently Asked Questions

Why child education solution ?

With child education solution, we at Nippon India Mutual Fund would help investors aim in accumulating money towards their child education goal by investing in Nippon India Mutual Fund scheme.

How it works?

To start accumulating units of Nippon India Mutual Fund towards Child Education goal, you can either invest easy monthly/quarterly/annual installments (SIP i.e. systematic investment Plan).

Below are the steps that are required to be followed under this solution -

- Present cost of desired education

- No. of years remained for the desired education to begin

- Invest systematically & aim to achieve the desired education corpus by Investing

Please note that the return and performance of the fund i is linked with the market and the return delivered by the scheme in which investment will be made may or may not be replicated in future.

What are the factors in calculating the SIP amount?

Below are the factors considered while calculating the SIP Amount –

- Expected Inflation Rate – It’s an assumed inflation rate (6% by default to help you know the future cost of desired education. The investor may change the inflation rate, if required.

- Assumed rate of return – Assumed 8% annualised rate of returns, which may or may not be achieved over a period of your goal.

Who can invest?

The units of the scheme are being offered to the public for subscription. The following persons (subject to purchase of units being permitted under their respective constitutions and relevant State Regulations) are eligible to subscribe to the units:

- Resident Adult Individuals, either single or jointly (not exceeding three).

- Non – resident Indians and persons of Indian origin residing abroad, on a full repatriation basis

- Parents / Lawful guardians on behalf of Minors

Please note that this is an indicative list. Nippon Life India Asset Management Limited (NAM India) reserves the right to include / exclude new / existing categories of investors to invest in this Scheme from time to time, subject to SEBI Regulations, if any.

What is the minimum investment amount?

Minimum investment amount for investing through SIP route is as follows:

Minimum investment amount for investing through SIP route is as follows:

- Rs.100/- per month and in multiples of Re. 1/- thereafter for minimum 60 months

- Rs.500/- per month and in multiples of Re. 1/- thereafter for minimum 12 months

- Rs.1000/- per month and in multiples of Re. 1/- thereafter for minimum 6 months

As per Scheme Information Document (SID), the initial minimum application amount for investing in

Nippon India Equity Hybrid Fund (Number of Segregated Portfolios – 2) is Rs. 500 and in multiples of Re. 1 thereafter. The Additional Purchase Amount for investing in the scheme is Rs. 500 and in multiples of Re. 1 thereafter.

Is there any lock-in period?

No, there is no lock-in period. However, if the investment is redeemed or switched out, it will be subject to applicable exit load as below.:

10% of the units allotted shall be redeemed without any exit load, on or before completion of 12 months from the date of allotment of units. Any redemption in excess of such limit in the first 12 months from the date of allotment shall be subject to the following exit load.

Redemption of units would be done on First in First out Basis (FIFO):

- 1% if redeemed or switched out on or before completion of 12 months from the date of allotment of units.

- Nil, if redeemed or switched out after completion of 12 months from the date of allotment of units.

Note – This is not applicable for Segregated Portfolios.

W.E.F. October 01, 2012, Exit Load If charged to the scheme shall be credited to the scheme immediately net of service tax, if any.

Pursuant to SEBI circular No.SEBI/IMD/CIR No. 14/120784/08 dated March 18, 2008, with effect from April 1, 2008, no entry load or exit load shall be charged in respect of units allotted on reinvestment of dividend.

The exit load mentioned is as on April 06, 2018. Investors are requested to refer the latest notice/addendum and SID of the scheme on the website or updated load details.

https://mf.nipponindiaim.com

Where will the funds be invested?

The funds will be invested in Nippon India Equity Hybrid Fund (Number of Segregated Portfolios – 2).

Nippon India Equity Hybrid Fund (Number of Segregated Portfolios – 2) is suitable for investors who are seeking*:

Long term capital growth.

Investment in equity and equity related instruments and fixed income instruments.

*Investors should consult their financial advisors

if in doubt about whether the product is suitable for them.

Why Nippon India Equity Hybrid Fund (Number of Segregated Portfolios – 2)?

Nippon India Equity Hybrid Fund (Number of Segregated Portfolios – 2) is a smart choice that may help you achieve your Child Education goal. The fund attempts to combine the growth potential of equities with low volatility of debt.

The primary investment objective of this scheme is to generate consistent return and appreciation of capital by investing in a mix of securities comprising of equity, equity related instruments and fixed income instruments. The Fund offers growth potential of Equity & stability of Debt investments. It is ideal for investors seeking combination of equity & fixed income returns with lower volatility & tax efficiency.

Instruments

Indicative asset allocation (% of total assets)

Minimum

Maximum

Risk Profile

High/Medium/Low

Equity & Equity Related Instruments

65

80

Medium to High

Debt and Money Market Instruments

20

35

Low to Medium

Units issued by REITs and InvITs

0

10

Medium to High

The asset allocation mentioned is as on April 28, 2018.

Investors are requested to refer the latest notice/addendum and SID of the scheme on the website

https://mf.nipponindiaim.com

for updated load details.

Click here

to download SID to know more about the scheme.

Click here

to know more about the fund performance.

Can I invest more whenever I have any surplus income or money?

Yes, you can additionally invest the surplus money you may have to reach your goal even faster.

All you need to do is Click on Invest More button and proceed with the transaction.

Please note that any additional investments will not be factored to change your easy monthly installment (SIP) amount and

goal tenure which was set at the time of planning child education goal.

Can I redeem before the goal tenure?

Yes, you can redeem partially or fully as per your need on any of the business days and redemption request will get processed subject to valid transaction. The redemption proceeds will accordingly be directly credited to your primary bank A/C registered in the folio within 3-4 working days from withdrawal date. However, if the investment is redeemed or switched out, it will be subject to applicable exit load.

Are there any charges or expenses if I redeem before the goal tenure?

The investors in the Nippon India Equity Hybrid Fund (Number of Segregated Portfolios – 2) will be charged Expenses in line with Regulation 52 of SEBI (Mutual Funds) Regulations, 1996 or such other basis as specified by SEBI from time to time. For the actual current expenses being charged, the investor should refer to the website of the mutual fund.

What will be the taxation implications?

Long-term capital gains in respect of Equity oriented mutual fund units

means gains on Equity Oriented mutual fund units held for a period of more than 12 months.

Long Term Capital gain from equity oriented mutual fund scheme was exempted up to 31.03.2018

from tax as per provision of sec 10 (38) of The Income Tax Act, 1961 .

Finance Act, 2018 has withdrawn the exemption as provided in clause (38) of section 10 of The Act.

Further, a new section 112 A inserted for taxability of long term capital gain arising from transfer of

a long term capital asset being an equity share in a company or a unit of equity oriented fund or a unit of

a business trust shall be taxed @10% if such capital gain exceeding Rs.1,00,000 p.a. w.e.f April 1, 2018

This concessional rate of 10 %. will be applicable to such long term capital gains, if—

in a case where long term capital asset is in the nature of an equity share in a company, securities

transaction tax has been paid on both acquisition and transfer of such capital asset; and

in a case where long term capital asset is in the nature of a unit of an equity oriented fund or

a unit of a business trust, securities transaction tax has been paid on transfer of such capital asset.

Further, the new provision of section 112A also proposes to provide the following:—

i) The long term capital gains will be computed without giving effect to the first and second

provisos to section 48, i.e. inflation indexation in respect of cost of acquisitions and cost of improvement,

if any, and the benefit of computation of capital gains in foreign currency in the case of a non-resident,

will not be allowed.

ii) The cost of acquisitions in respect of the long term capital asset

acquired by the assessee before the 1st day of February, 2018, shall be deemed to be the higher of –

a) the actual cost of acquisition of such asset; and

b) the lower of –

(I) the fair market value of such asset; *and

(II) the full value of consideration received or accruing as a result of the transfer of the capital asset.

*Fair market value has been defined to mean –

a) in a case where the capital asset is listed on any recognized stock exchange, the highest price

of the capital asset quoted on such exchange on the 31st day of January, 2018. However, where there is no

trading in such asset on such exchange on the 31st day of January, 2018 , the highest price of such asset on

such exchange on a date immediately preceding the 31st day of January, 2018 when such asset was traded on such

exchange shall be the fair market value; and

b) in a case where the capital asset is a unit and is not listed on recognized stock exchange, the net

asset value of such asset as on the 31st day of January, 2018.

Explanation.—For the purposes of this section,— (a) “equity oriented fund” means a fund set up under a scheme of a mutual fund specified under clause (23D) of section 10 and,—

(i) in a case where the fund invests in the units of another fund which is traded on a recognised stock exchange,—

(A) a minimum of ninety per cent. of the total proceeds of such fund is invested in the units of such other fund; and

(B) such other fund also invests a minimum of ninety per cent. of its total proceeds in the equity shares of domestic companies listed on a recognised stock exchange; and

(ii) in any other case, a minimum of sixty-five per cent. of the total proceeds of such fund is invested in the equity shares of domestic companies listed on a recognised stock exchange: Provided that the percentage of equity shareholding or unit held in respect of the fund, as the case may be, shall be computed with reference to the annual average of the monthly averages of the opening and closing figures;

Short Term Capital Gains ( redemption before 1 Year) will be taxable @ 15% .

The tax rates will be increased by surcharge, Health and education cess as applicable.

Finance Act 2018 withdrawn “Education Cess on income-tax” and “Secondary and Higher Education Cess on income-tax” .

and inserted , a new cess “Health and Education Cess” shall be levied at the rate of 4% of income tax including surcharge

wherever applicable w.e.f April 1, 2018.

Further Investor is required to refer SID and SAI of the scheme for details tax provisions.

The Investor should consult a tax expert for further details.

Mutual fund Investments are subject to market risks, read all scheme related documents carefully.

Why child education solution ?

With child education solution, we at Nippon India Mutual Fund would help investors aim in accumulating money towards their child education goal by investing in Nippon India Mutual Fund scheme.

How it works?

To start accumulating units of Nippon India Mutual Fund towards Child Education goal, you can either invest easy monthly/quarterly/annual installments (SIP i.e. systematic investment Plan).

Below are the steps that are required to be followed under this solution -

- Present cost of desired education

- No. of years remained for the desired education to begin

- Invest systematically & aim to achieve the desired education corpus by Investing

Please note that the return and performance of the fund i is linked with the market and the return delivered by the scheme in which investment will be made may or may not be replicated in future.

What are the factors in calculating the SIP amount?

Below are the factors considered while calculating the SIP Amount –

- Expected Inflation Rate – It’s an assumed inflation rate (6% by default to help you know the future cost of desired education. The investor may change the inflation rate, if required.

- Assumed rate of return – Assumed 8% annualised rate of returns, which may or may not be achieved over a period of your goal.

Who can invest?

The units of the scheme are being offered to the public for subscription. The following persons (subject to purchase of units being permitted under their respective constitutions and relevant State Regulations) are eligible to subscribe to the units:

- Resident Adult Individuals, either single or jointly (not exceeding three).

- Non – resident Indians and persons of Indian origin residing abroad, on a full repatriation basis

- Parents / Lawful guardians on behalf of Minors

Please note that this is an indicative list. Nippon Life India Asset Management Limited (NAM India) reserves the right to include / exclude new / existing categories of investors to invest in this Scheme from time to time, subject to SEBI Regulations, if any.

What is the minimum investment amount?

Minimum investment amount for investing through SIP route is as follows:

Minimum investment amount for investing through SIP route is as follows:

- Rs.100/- per month and in multiples of Re. 1/- thereafter for minimum 60 months

- Rs.500/- per month and in multiples of Re. 1/- thereafter for minimum 12 months

- Rs.1000/- per month and in multiples of Re. 1/- thereafter for minimum 6 months

As per Scheme Information Document (SID), the initial minimum application amount for investing in Nippon India Equity Hybrid Fund (Number of Segregated Portfolios – 2) is Rs. 500 and in multiples of Re. 1 thereafter. The Additional Purchase Amount for investing in the scheme is Rs. 500 and in multiples of Re. 1 thereafter.

Is there any lock-in period?

No, there is no lock-in period. However, if the investment is redeemed or switched out, it will be subject to applicable exit load as below.:

10% of the units allotted shall be redeemed without any exit load, on or before completion of 12 months from the date of allotment of units. Any redemption in excess of such limit in the first 12 months from the date of allotment shall be subject to the following exit load.

Redemption of units would be done on First in First out Basis (FIFO):

- 1% if redeemed or switched out on or before completion of 12 months from the date of allotment of units.

- Nil, if redeemed or switched out after completion of 12 months from the date of allotment of units.

Note – This is not applicable for Segregated Portfolios.

W.E.F. October 01, 2012, Exit Load If charged to the scheme shall be credited to the scheme immediately net of service tax, if any.

Pursuant to SEBI circular No.SEBI/IMD/CIR No. 14/120784/08 dated March 18, 2008, with effect from April 1, 2008, no entry load or exit load shall be charged in respect of units allotted on reinvestment of dividend.

The exit load mentioned is as on April 06, 2018. Investors are requested to refer the latest notice/addendum and SID of the scheme on the website or updated load details. https://mf.nipponindiaim.com

Where will the funds be invested?

The funds will be invested in Nippon India Equity Hybrid Fund (Number of Segregated Portfolios – 2).

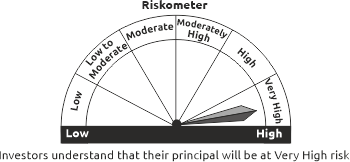

|

Nippon India Equity Hybrid Fund (Number of Segregated Portfolios – 2) is suitable for investors who are seeking*: *Investors should consult their financial advisors if in doubt about whether the product is suitable for them. |

|

Why Nippon India Equity Hybrid Fund (Number of Segregated Portfolios – 2)?

Nippon India Equity Hybrid Fund (Number of Segregated Portfolios – 2) is a smart choice that may help you achieve your Child Education goal. The fund attempts to combine the growth potential of equities with low volatility of debt.

The primary investment objective of this scheme is to generate consistent return and appreciation of capital by investing in a mix of securities comprising of equity, equity related instruments and fixed income instruments. The Fund offers growth potential of Equity & stability of Debt investments. It is ideal for investors seeking combination of equity & fixed income returns with lower volatility & tax efficiency.

| Instruments |

|

|

|||||||

| Equity & Equity Related Instruments | 65 | 80 | Medium to High | ||||||

| Debt and Money Market Instruments | 20 | 35 | Low to Medium | ||||||

| Units issued by REITs and InvITs | 0 | 10 | Medium to High | ||||||

The asset allocation mentioned is as on April 28, 2018. Investors are requested to refer the latest notice/addendum and SID of the scheme on the website https://mf.nipponindiaim.com for updated load details.

Click here to download SID to know more about the scheme.

Click here to know more about the fund performance.

Can I invest more whenever I have any surplus income or money?

Yes, you can additionally invest the surplus money you may have to reach your goal even faster. All you need to do is Click on Invest More button and proceed with the transaction. Please note that any additional investments will not be factored to change your easy monthly installment (SIP) amount and goal tenure which was set at the time of planning child education goal.

Can I redeem before the goal tenure?

Yes, you can redeem partially or fully as per your need on any of the business days and redemption request will get processed subject to valid transaction. The redemption proceeds will accordingly be directly credited to your primary bank A/C registered in the folio within 3-4 working days from withdrawal date. However, if the investment is redeemed or switched out, it will be subject to applicable exit load.

Are there any charges or expenses if I redeem before the goal tenure?

The investors in the Nippon India Equity Hybrid Fund (Number of Segregated Portfolios – 2) will be charged Expenses in line with Regulation 52 of SEBI (Mutual Funds) Regulations, 1996 or such other basis as specified by SEBI from time to time. For the actual current expenses being charged, the investor should refer to the website of the mutual fund.

What will be the taxation implications?

Long-term capital gains in respect of Equity oriented mutual fund units

means gains on Equity Oriented mutual fund units held for a period of more than 12 months.

Long Term Capital gain from equity oriented mutual fund scheme was exempted up to 31.03.2018

from tax as per provision of sec 10 (38) of The Income Tax Act, 1961 .

Finance Act, 2018 has withdrawn the exemption as provided in clause (38) of section 10 of The Act.

Further, a new section 112 A inserted for taxability of long term capital gain arising from transfer of a long term capital asset being an equity share in a company or a unit of equity oriented fund or a unit of a business trust shall be taxed @10% if such capital gain exceeding Rs.1,00,000 p.a. w.e.f April 1, 2018This concessional rate of 10 %. will be applicable to such long term capital gains, if—

in a case where long term capital asset is in the nature of an equity share in a company, securities transaction tax has been paid on both acquisition and transfer of such capital asset; and

in a case where long term capital asset is in the nature of a unit of an equity oriented fund or a unit of a business trust, securities transaction tax has been paid on transfer of such capital asset.

Further, the new provision of section 112A also proposes to provide the following:—

i) The long term capital gains will be computed without giving effect to the first and second

provisos to section 48, i.e. inflation indexation in respect of cost of acquisitions and cost of improvement,

if any, and the benefit of computation of capital gains in foreign currency in the case of a non-resident,

will not be allowed.

ii) The cost of acquisitions in respect of the long term capital asset acquired by the assessee before the 1st day of February, 2018, shall be deemed to be the higher of –

a) the actual cost of acquisition of such asset; and

b) the lower of –

(I) the fair market value of such asset; *and

(II) the full value of consideration received or accruing as a result of the transfer of the capital asset.

*Fair market value has been defined to mean –

a) in a case where the capital asset is listed on any recognized stock exchange, the highest price

of the capital asset quoted on such exchange on the 31st day of January, 2018. However, where there is no

trading in such asset on such exchange on the 31st day of January, 2018 , the highest price of such asset on

such exchange on a date immediately preceding the 31st day of January, 2018 when such asset was traded on such

exchange shall be the fair market value; and

b) in a case where the capital asset is a unit and is not listed on recognized stock exchange, the net

asset value of such asset as on the 31st day of January, 2018.

Explanation.—For the purposes of this section,— (a) “equity oriented fund” means a fund set up under a scheme of a mutual fund specified under clause (23D) of section 10 and,—

(i) in a case where the fund invests in the units of another fund which is traded on a recognised stock exchange,—

(A) a minimum of ninety per cent. of the total proceeds of such fund is invested in the units of such other fund; and

(B) such other fund also invests a minimum of ninety per cent. of its total proceeds in the equity shares of domestic companies listed on a recognised stock exchange; and

(ii) in any other case, a minimum of sixty-five per cent. of the total proceeds of such fund is invested in the equity shares of domestic companies listed on a recognised stock exchange: Provided that the percentage of equity shareholding or unit held in respect of the fund, as the case may be, shall be computed with reference to the annual average of the monthly averages of the opening and closing figures;

Short Term Capital Gains ( redemption before 1 Year) will be taxable @ 15% .

The tax rates will be increased by surcharge, Health and education cess as applicable.

Finance Act 2018 withdrawn “Education Cess on income-tax” and “Secondary and Higher Education Cess on income-tax” .

and inserted , a new cess “Health and Education Cess” shall be levied at the rate of 4% of income tax including surcharge

wherever applicable w.e.f April 1, 2018.

Further Investor is required to refer SID and SAI of the scheme for details tax provisions.

The Investor should consult a tax expert for further details.